Product Discovery is an essential part of Product Management and yet, the art of doing it well still remains elusive.

Enter Melissa Klemke, Head of Product at Prezzee, who taught us how to win the Product Discovery game – with a little Bingo! (Slides at the end of this post)

Why do Discovery?

Have you ever worked with an organisation that allocated resources and spent months or years building something big that nobody ended up wanting?

Have you ever caught yourself thinking that because you’ve known the user base for years, surely, you know exactly what to build!

Or have you built something only to realise someone else has already built it and even better?

Hence, the purpose of Discovery is to reduce the risk of failure and uncertainty.

In Product Management, there are 4 primary types of risks

- Value Risk: will customers buy it? Will they use it?

- Viability Risk: can it work as part of our business model?

- Usability Risk: can the users figure out how to use it?

- Feasibility Risk: can the team build it with the time, skills and tools available?

Source: The Four Big Risks

The Role of Product Managers in Discovery

While discovery should involve all members of the product trio, Product Managers are primarily focused on addressing Value and Viability Risks whereas Designers focus Usability Risks and Engineering on Feasibility Risks.

In Melissa’s talk, she focused on what the Product Manager can do to reduce Value and Viability risk.

Common Mistake(s) in Discovery

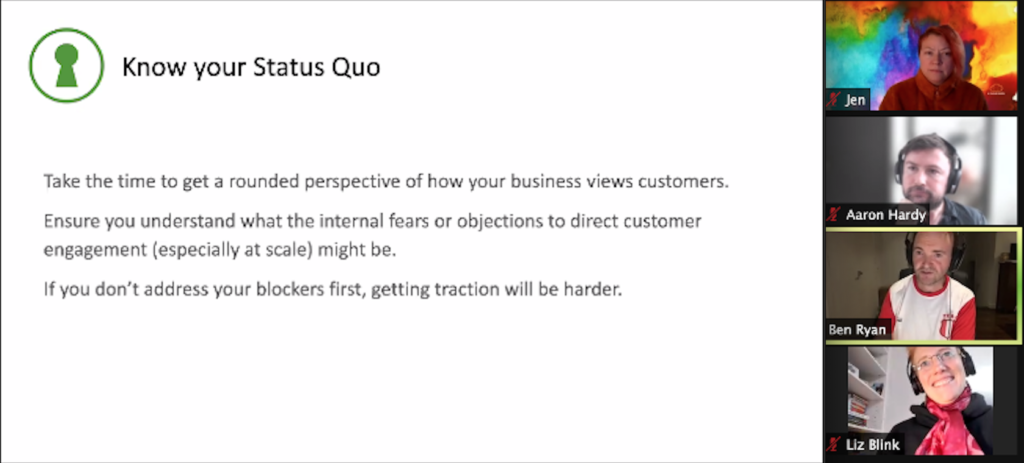

Mistake #1 in discovery is assuming everything will work out perfectly. The customer will love it (value), they’ll know how to use it (usability), and they’ll pay a lot of money for it (viability). Until they don’t. Strong assumptions lead to high risk. But how do some companies end up in that position?

In some cases, time constraints can lead to assumptions being made. It can be tempting to substitute customer research with internal subject matter experts (SMEs) who represent ‘the voice of the customer’. Perhaps an hour of making product decisions with a SME can save an organisation a couple of weeks of discovery – but in the grand scheme of things, saving 2 weeks of time in discovery may not be worth it, if you end up spending months of time and money building a feature nobody wants.

The thing is, every user is different. An SME is a single person and it’s challenging for this single point of view to accurately represent the nuances and needs of multiple personas. Even more so when the needs are of an organisation with multiple personas and processes to support. Moreover, an SME is a power user and may overlook counter-intuitive experiences for the regular user.

Where to start? Talk to customers!

A quick and easy way to address Value Risk is running customer interviews.

Imagine this, a work desk with you the interviewer, the interviewee and a couple of your teammates who are observing and taking notes. You’re recording the session and you’ve asked for permission.

Talking to Customers: The Script

Before you actually talk to the customers, you need to prepare your script and have clear goals Document your own internal objective of assumptions/hypotheses that you’re trying to prove or disprove along with what behaviours you’re trying to learn more about. This is your anchor throughout the interview.

When you talk to the customer, set clear expectation with the customer “We’re here to learn about how you carry out X,Y, Z process. Your insights will help us shape our decisions for A, B, C”. You are not there to take feature requests.

Have 5-7 questions that will be asked of each customer so that it’s easy to identify patterns of similarities and differences. It’s difficult to get good insights if you’re just winging it and asking different questions each time!

Talking to Customers: Behind The Scenes

Everyone knows it’s hard to take notes while talking. Melissa recommends setting up a digital whiteboard for the team to take notes.

In a shared document, have team members contribute notes. There may repetitive notes or different notes – you can address that later. Just get it down on paper or docs or post-its (virtual or other).

Melissa shared “nothing gives me more pleasure than hearing two engineers argue about what they heard the customer say. Involving them makes them more customer-centric.” It also makes it easier for the team to discuss customer impact and trade-offs for the solution later.

Separately, create a separate space for the team to draft and ask questions that pop up during the interview.

Talking to Customers: Recruiting

It takes a village! Treat it like a program that needs to be managed. Give it a cool name (When Melissa worked at ELMO, they called it ELMO Loop to ‘close the loop’), sort out messaging (“shape our next big thing!) and Expressions of Interest forms.

Leverage your wider customer-facing team members (Customer Success, Account Managers, Implementation, Sales) to roll out the red carpet for your “customer advisory board”.

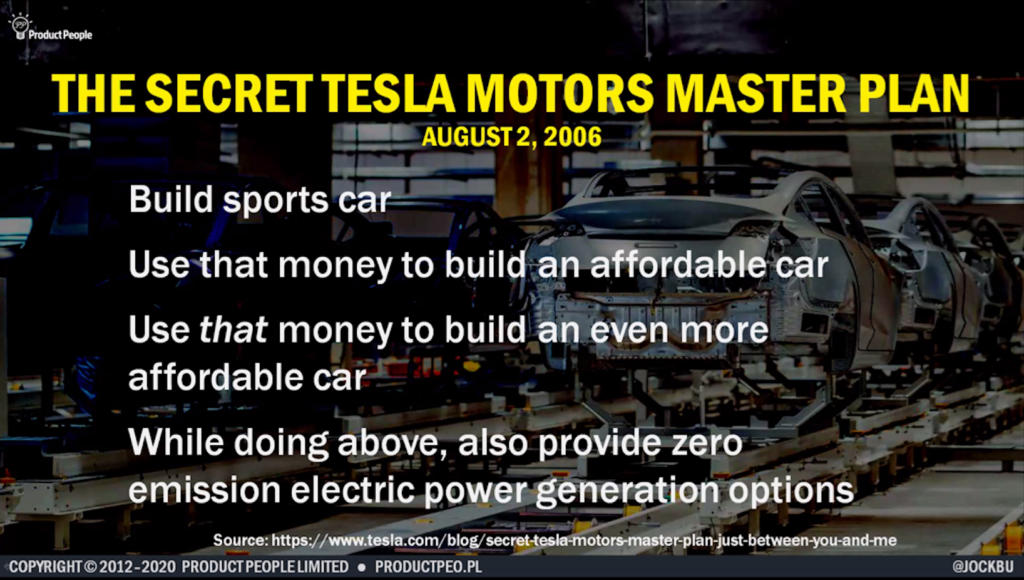

You can also do – Competitor Teardowns

During the Bingo activity that Melissa ran, competitor teardowns received the most interest from the audience as something new they’d try. It’s useful for assessing Value and Feasibility Risk.

Melissa recommends targeting 5 competitor websites and:

- Rope in your sales, marketing & product team members

- On a digital whiteboard, break down the user journey. Go page by page and spend 5 minutes talking about each page.

- Talk about – likes and dislikes, the clarity of the messaging, what their price structure is (free? subscription? how much $$)

- Assess the patterns – what are the similarities & differences between competitors

- Decide if you will ignore, copy or make it better than your competitors

Thank you to our hosts – Propel Ventures!

At Propel, we’re dedicated to helping businesses achieve sustained product success. That means not only bringing your product ideas to life, but also ensuring that they remain relevant and successful over time. With our unique blend of software development and product strategy services, we offer a comprehensive approach that goes beyond just delivering a product. Our goal is to help you create long-lasting results that drive growth and success for your business.

Founded in 2016, we are a team of entrepreneurial product strategy, design and development leaders with a track record of building businesses, creating and expanding markets, and developing new technologies that benefit millions of people across the globe. https://www.propelventures.com.au/

ProductAnonymous-April2024-WinProductDiscovery-MelissaKlemke from Product Anonymous